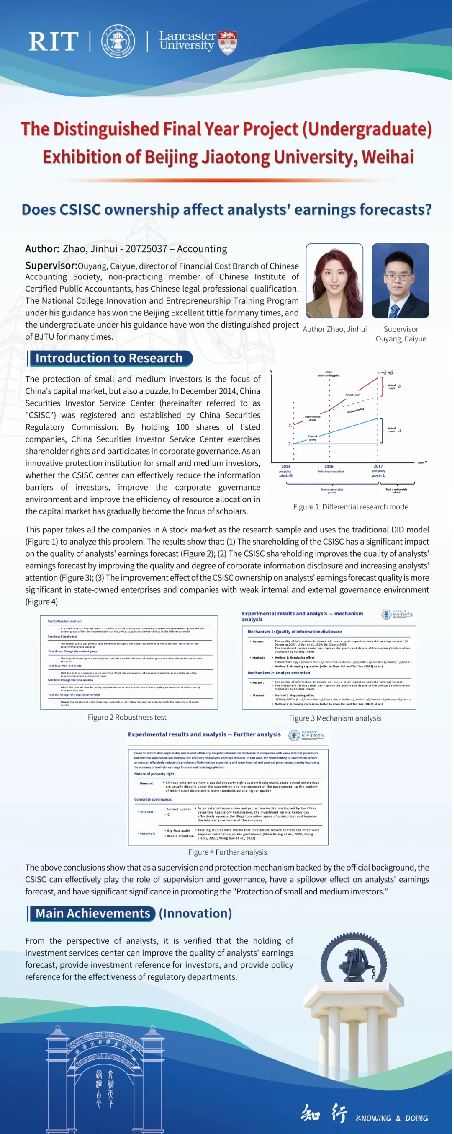

ZHAO Jinhui

This paper takes listed companies from 2013 to 2017 as the research sample. This paper uses the double difference model to analyze whether the investment service center can effectively reduce the investor information barriers and improve the corporate governance environment, and this paper verifies that the investment service center shareholding can improve the quality of analysts' surplus forecasts from the analysts' point of view. It provides investment references for investors and policy reference suggestions for the effectiveness of regulatory authorities.

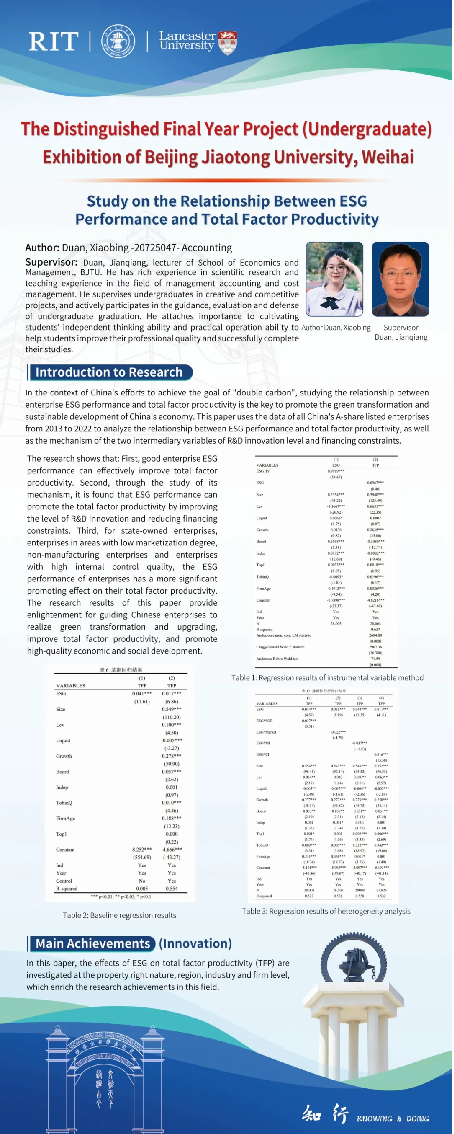

Duan Xiaobing

This paper uses the data of all A-share listed enterprises in China from 2013 to 2022 to analyze the relationship between corporate ESG performance and total factor productivity and the mechanism of the two mediating variables, namely, the level of corporate R&D and innovation and financing constraints, in it. The paper examines the differences in the impact of ESG on total factor productivity for the nature of property rights, region, industry and firm level respectively, which enriches the research results in this field.

Wang Chenfei

This study selects China's A-share listed companies from 2013 to 2022 as the research sample, and studies the surplus quality of China's listed companies based on the background of digital transformation. The relationship between the two is explored through basic regression, robustness test and heterogeneity grouping analysis, and the necessity of digital transformation is argued.

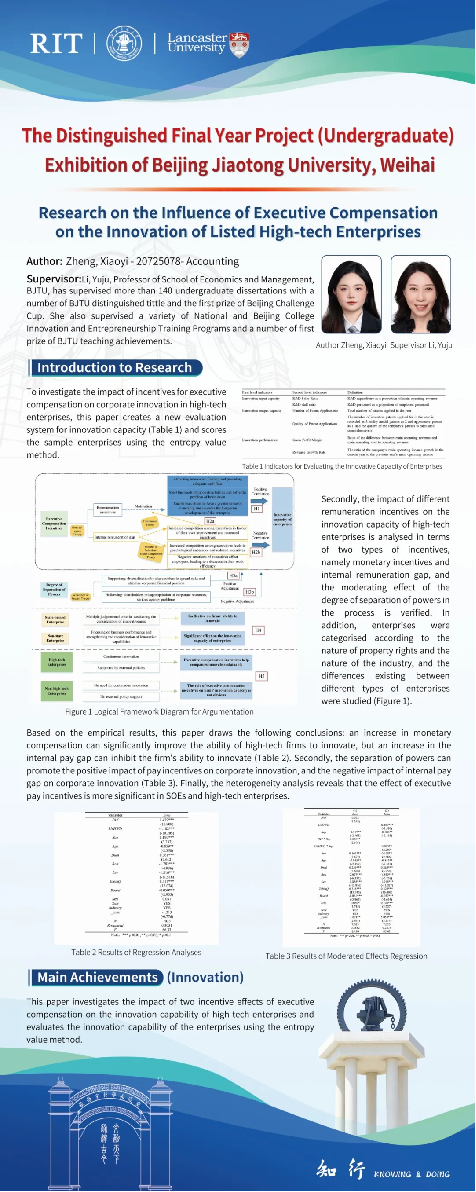

Zheng Xiaoyi

In this paper, in order to study the impact of incentives of executive compensation on corporate innovation in high-tech enterprises, a new evaluation system of innovation ability was created and the entropy method was applied to score the sample enterprises. It also analyzes the impact of different compensation incentives on the innovation ability of high-tech enterprises from two incentive methods: monetary incentives and internal pay gap.

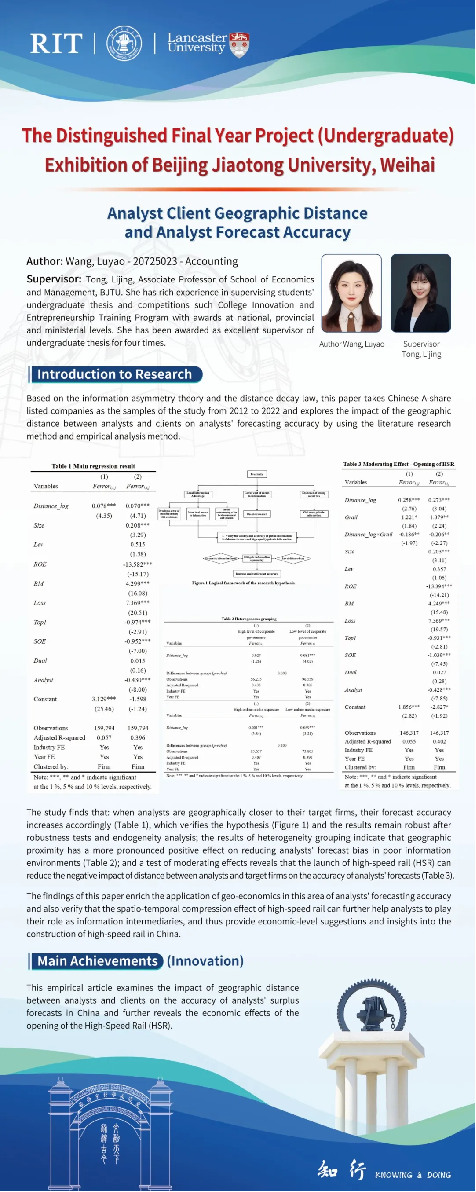

Wang Luyao

Based on the information asymmetry theory and the distance decay law, this paper takes Chinese A-share listed companies as the research sample from 2012 to 2022, and utilizes the literature research method and empirical analysis to explore the impact of the geographic distance between analysts-customers on the accuracy of analysts' forecasts, and further reveals the economic effect of the opening of high-speed railways.